A Tale Of Two Tax Relief Programs ; Pictures Tell The Story; Assessing Assessments; Inexcusable Fire Trap; The Cost of Transparency.

RVA 5x5 - September 15, 2023

No algorithms. No content filters. Honest and insightful analysis from Richmond, VA.

This week check out our five stories on:

City Hall changes its tune on going after seniors in their houses with a tax sale as Henrico puts forth a plan to help seniors stay in place and cap their real estate taxes….

Speaking of real estate taxes, we have a quick look at the latest assessments and where taxes are going up the most the fastest…

A disgraceful look at some of the fire inspection reports at Richmond Public Schools that has students and staff in dangerous buildings daily…

Continuing on the schools theme, we take a quick look at the state’s release of information about the city’s SOL scores…

The cost of transparency as part of VCU’s successful growth and the odd one-off development project at VCU Health that lacked transparency and now has a huge (and still growing) tab….

STORY #1 — A Tale Of Two Tax Relief Programs

You can’t get a much bigger contrast of the efficacy of government or its priorities than how it treats its seniors. I am referring to many seniors who have lived, worked, and raised generations of family in one house or one neighborhood, paid generations of taxes and always helped their neighbors, only to be letdown and disappointed by the government that is supposed to serve and help them.

Such an example is playing out before our very eyes this summer: the City of Richmond was pursuing a policy to pursue tax sale proceedings against seniors living in their homes who are tax delinquent on their real estate taxes while Henrico County this week announced they are capping real estate taxes for those over 65 going forward.

Talk about a tale of two localities.

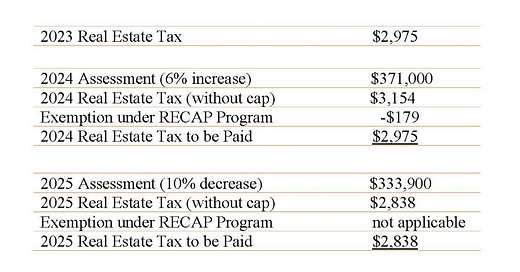

In the Henrico news email sent this week, they unveiled the Real Estate CAP Program (RECAP), which is the first of its kind in Virginia that would lock in annual real estate tax bills so future bills would not exceed the bill they pay the year they enter the program (which will begin in early 2024). So if a qualifying Henrico homeowner pays $2,5000 in real estate taxes annually this year and they enter the RECAP program, no matter how much the assessment rises in future years, their real estate tax bill would remain at $2,500. (And if the tax bill went below what they were paying, they would also pay the lower amount billed).

Applicants for the RECAP program must meet the criteria that include living in the dwelling and being the title holder of the property, being at least 65 years of age or 100% permanently and totally disabled, not have a net worth of more than $700,000 (excluding the dwelling and land up to 10 acres), and have a household net income of $105,000 or less (excluding live-in caretakers).

The new RECAP program is an extension of the county’s existing Real Estate Advantage Program (REAP) which was started in 1973 and offers tax exemptions up to $3,200 with a net worth of $500,00 or less and a household income of $75,000 or less. A resident who may not qualify for the RECAP program could still benefit from the REAP program, which helped about 6,000 residents in 2022 and saved them $11 million collectively.

Rising assessments across the region lead to higher tax bills and it has put stress on homeowners’ budgets. Three Chopt Supervisor Tommy Branin, who championed the program to the Henrico Board of Supervisors and received unanimous approval, summed it up:

“As we worked on our budget this spring, it became clear that our new tax relief measures – specifically, another real estate tax credit and a lowering of the personal property tax rate – were only the start of what we needed to do. With RECAP, we will help provide predictability to our seniors’ expenses, which will be a great help to those living on fixed incomes.”

Keep reading with a 7-day free trial

Subscribe to RVA 5x5 to keep reading this post and get 7 days of free access to the full post archives.